•

Interest rate cycles have

peaked both globally and in

India.

• Investors should add duration

with every rise in yields.

•

Mix of 10-year duration and

2-4-year duration assets are

best strategies to invest in the

current macro environment.

•

Credits continue to remain

attractive from a risk reward

perspective give the improving

macro fundamentals.

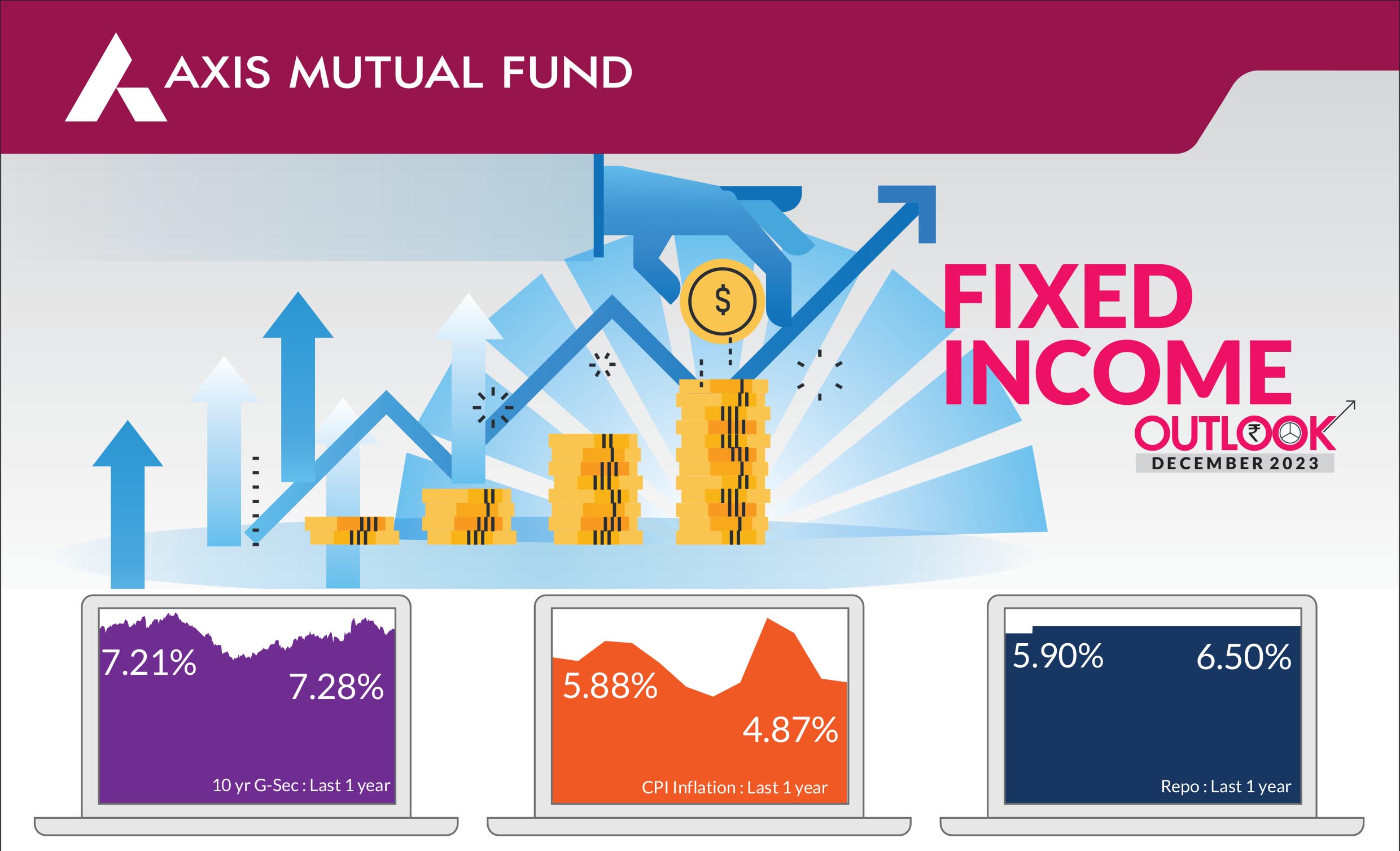

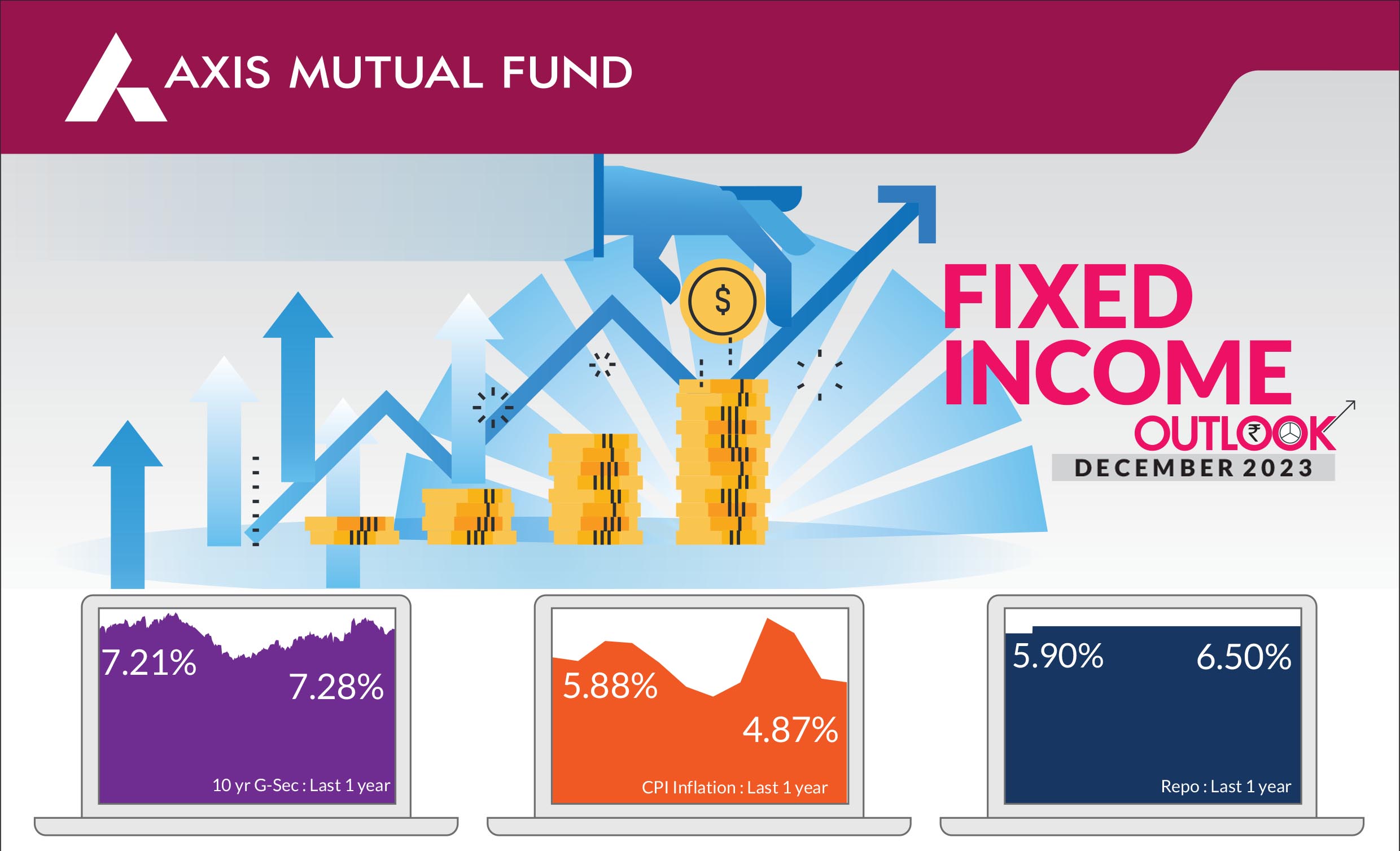

Indian government bond yields fell over the month, trading in a band of 7.21-7.35% and ending at 7.28%. The key factors driving the bond markets were a decline in US Treasury yields, the diminished intensity of the geopolitical conflict between Israel and Hamas, and expectations that the central banks in India and the US would keep interest rates on hold in their December policy meetings.

► US Treasury yields retreat over

the month:

US Treasury yields

finally relented in November and

edged lower amidst optimism

that the US Federal Reserve

(Fed) could be finally been at the

peak of its interest rate hikes and no more hikes were in order. The yields

on the 10-year Treasury fell to 4.3%, a significant decline of 63 bps from

previous month's close of 4.93%. Meanwhile, the yields on the 2 year

Treasuries have fallen lesser than the longer end leading to the yield

curve getting less inverted to flat. Markets expect the Fed to remain on

hold in its December policy meeting. Even as the GDP data remained

strong, large amount of data is pointing to softer growth including the

unemployment numbers. The US dollar has been weakening against the

developed economies but gained ground against the emerging markets.

► Inflationary pressures and oil prices head lower:

Headline inflation

edged further lower to 4.9% in October vs 5.02% in September despite a

rise in the vegetable prices, particularly that of onions. Core inflation, too

softened to 4.3% vs 4.6% in September. While inflation is within the

central bank's band of 2-6%, it could rise further in the near term as the

base effect wears off. However, inflation should soon be heading lower

thereafter once the new crop comes in. In the upcoming monetary policy

meeting between 6-8 December, we expect the Reserve Bank of India

(RBI) to remain on hold. Crude oil prices declined over the month to $84

levels and briefly touched 77-78 levels during the month. This is despite

OPEC and its allies reducing supply by 1 million barrels as the demand

outlook remains weak.

► Economic growth remains resilient: India's GDP expanded 7.6% during the second quarter vs the 7.8% growth of the first quarter. While the numbers were a tad lower, they were better than the market expectations. Investments led the growth aided by government capex and government expenditure remained strong. Private consumption growth was weak. In 1HFY24, GDP growth at 7.7% led by investment growth at 9.5% while personal consumption growth was at 4.5%. Manufacturing sector growth at 13.9% was led by favorable base effects and high profitability aided by low input costs. Construction sector growth at 13.3% vs 7.9% in 1QFY24 continued to reflect the government's capex thrust.

► Economic growth remains resilient: India's GDP expanded 7.6% during the second quarter vs the 7.8% growth of the first quarter. While the numbers were a tad lower, they were better than the market expectations. Investments led the growth aided by government capex and government expenditure remained strong. Private consumption growth was weak. In 1HFY24, GDP growth at 7.7% led by investment growth at 9.5% while personal consumption growth was at 4.5%. Manufacturing sector growth at 13.9% was led by favorable base effects and high profitability aided by low input costs. Construction sector growth at 13.3% vs 7.9% in 1QFY24 continued to reflect the government's capex thrust.

Market view

As we have been highlighting since last few months, interest rates have peaked globally, particularly in the US. Incrementally data such as housing, unemployment and inflation has started to gradually soften indicating a slowdown on the horizon. We expect the rates to stay steady before the Fed starts taking a dovish stance from February 2024 onwards.On the domestic front, after the sell-off witnessed post the October monetary policy, yields are back to pre-policy levels last seen in October. We do not expect any surprises from the central bank and expect it to remain on a pause. On the macro front, softer inflation and a 15% fall in crude oil prices from their peaks have given leeway to the RBI and any inflation surprises in the November numbers will not be a cause of concern. In the last two months, ie post the October policy, the RBI indirectly engineered an interest rate hike through its hawkish stance and the threat of OMO sales. Consequently, the operative rate has been 6.75%, vs the 6.5%. We expect the RBI to revert to 6.5% by February 2024 and by April RBI would be at a dovish stance.

As compared to the other economies, India remains on a stronger growth trajectory. Incoming data has been firm and we do expect this to continue. The likely inclusion of government bonds in Bloomberg indices could boost inflows.

Most part of the fixed income curve is pricing in no cuts for the next six months. We reiterate that interest rates have peaked globally and in India. With policy rates remaining incrementally stable, we have maintained a long duration stance across our portfolios within the respective scheme mandates. We do expect the 10-year bond yields to touch 6.75% by April - June 2024.

From a strategy perspective, we continue to add duration across portfolios within the respective investment mandates. We expect our duration call to add value in the medium term. Investors could use this opportunity to top up on duration products with a structural allocation to short and medium duration funds and a tactical play on GILT funds.

Source: Bloomberg, Axis MF Research.